We'll Guide You

The easiest way to register an LLC in New York is to have a New York registered agent do it for you.

We’re here in Albany, in our own building, and we communicate with the secretary of state’s office daily.

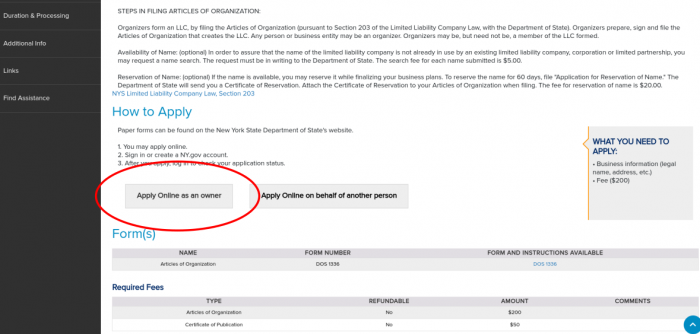

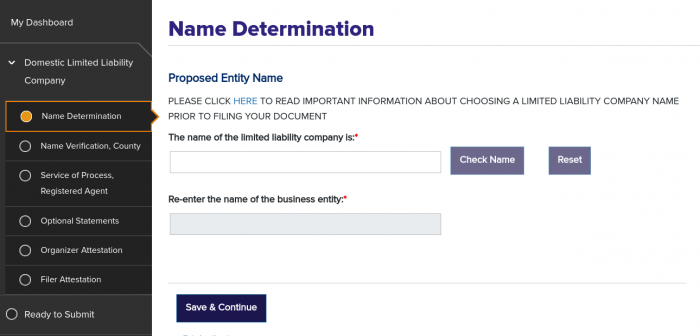

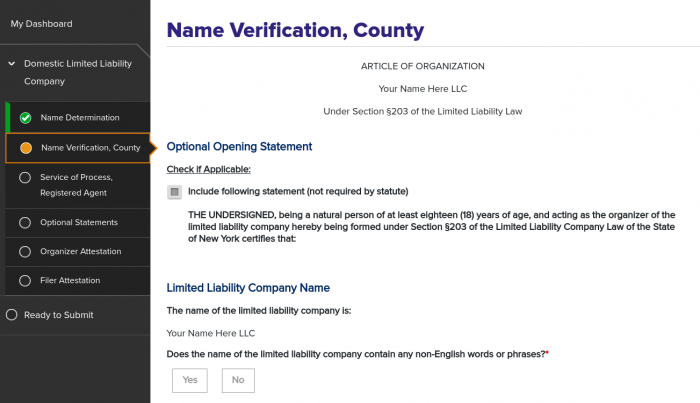

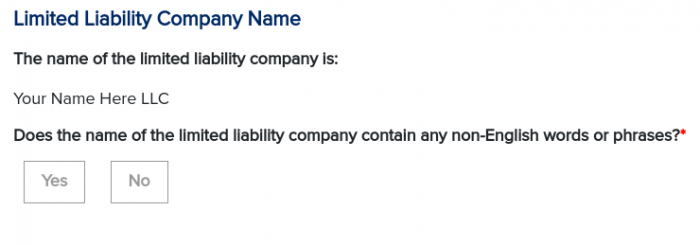

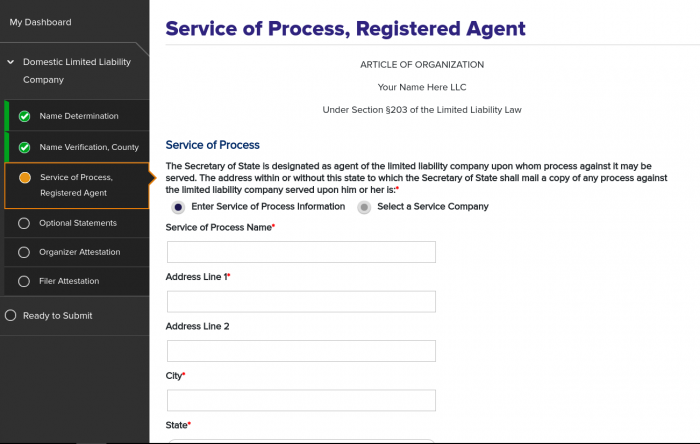

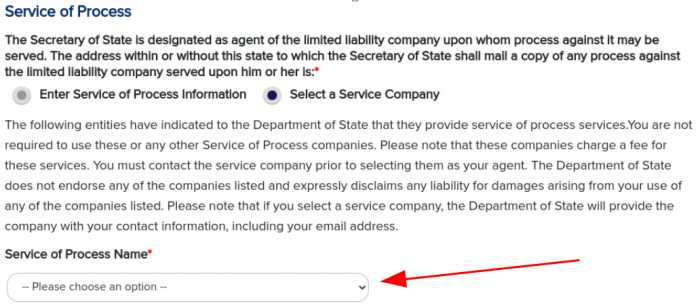

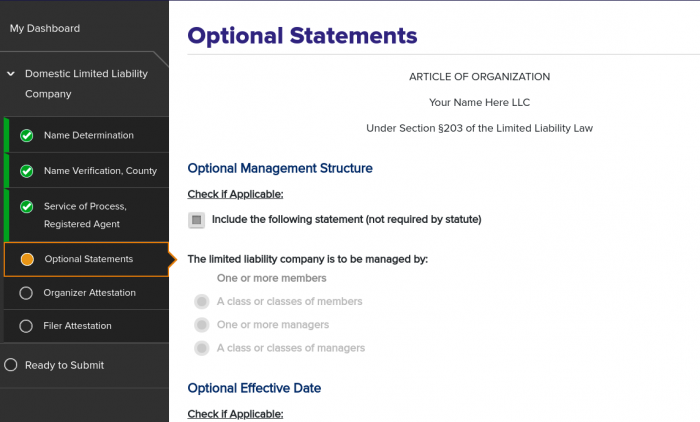

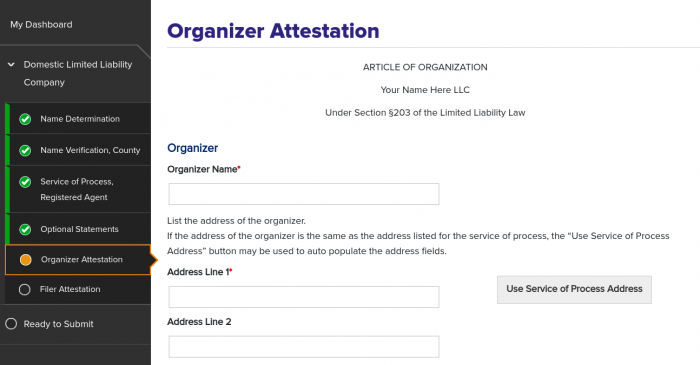

Alternatively, you can do it yourself. And we can show you how.