Start an LLC in New York

Forming a New York LLC isn’t for the faint of heart.

On top of filing your Articles of Organization, you’ve got to fulfill the state’s LLC Publication Requirement, which takes weeks — and hundreds of dollars — to complete. And if you mess up the requirement, you have to start over.

Avoid the bureaucracy and save money with our LLC Formation Service, which includes a year of registered agent service and free use of our business address in Albany, where publishing costs are cheaper.

You’ll also have access to additional services to amplify your professionalism and keep you organized, such as mail scanning, virtual office, and business website & phone.

Get Effortless NY LLC Formation:

What do you get with our LLC Formation Service?

Our LLC Formation Service is second to none and packed with perks.

- Quick, Accurate LLC Filing with the Division of Corporations

- Albany Business Address for Privacy and Cheaper Publication Costs

- One Year of NY Registered Agent Service

- Free Attorney-Drafted Operating Agreement

- LLC Membership Certificates and Resolutions

- Ability to Add NY Publication Service

- Business Website, Email, and NY Phone Number (Free for 90 days)

- Free Domain Name for First Year

- Enrollment in Renewal Service Plus NY Biennial Report Reminders

- Lifetime Support From Our Expert Staff

- Access Your Secure Account Anywhere, Anytime

- Additional Services and Filings Available

How to Start a NY LLC In 7 Steps

Whether you decide to hire us or choose to form your business yourself, here’s everything you need to know.

1. Decide who will form your LLC

2. Choose your LLC name

3. Select a NY Registered Agent

4. Register your LLC with the Division of Corporations

5. Complete the LLC Publication Requirement

6. Create an LLC Operating Agreement

7. Get an EIN

1. Decide Who Will Form Your LLC

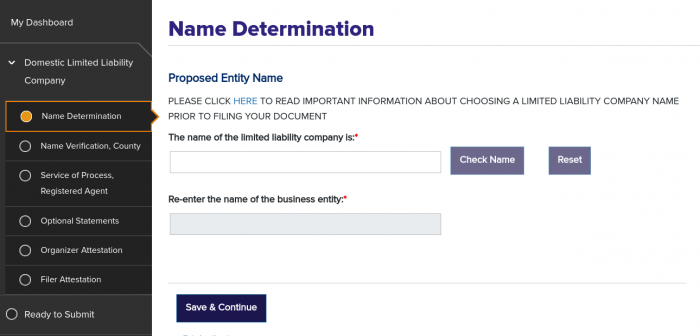

The first thing you need to do when starting an LLC in New York is make a decision: will you hire a professional service to create your LLC or are you going to do it yourself? Our NY LLC formation guide is primarily built for those want to know how to form an LLC on their own, but we’d be remiss not to call out your options.

Benefits of forming an LLC yourself:

- You save money: Cost savings is primary benefit of starting a NY LLC yourself. No extra money paid out to a 3rd party. You keep that money and spend it how you like. And fortunately for you, forming an LLC in New York isn’t complicated, but it is very particular.

Benefits of hiring us to register your LLC:

- Save time, worry less: When you hire us to create your LLC, the process is simple. Just enter personal contact and business details, pay $149 plus the state fees, and in one to two business days, you’ll have an LLC.

- Customized LLC operating agreement & business forms library: We provide all of our LLC clients with a lawyer-drafted operating agreement customized for your LLC structure, a bank resolution to open a bank account, and lifetime access to hundreds of other state and legal documents.

- Save money on the NY publication requirement: When you use our Albany address as your business address, you can publish notice of your LLC in Albany, where publication costs are typically hundreds of dollars cheaper than in NYC.

- Get all the business services you need in one place: We’re your one-stop shop for doing business in the Big Apple. With your registered agent service, you can get a business website, professional email, and phone service FREE for the first 90 days. We even include a free domain name for an entire year.

- We’ll file your biennial statement: We’ll send real-time reminders before your biennial statement is due and then file it for you for $100 + the state fee (charged at filing). That way, it’s easy to keep your business in good standing with the state. If you’d rather handle this state filing on your own, you can cancel this service in your online account.

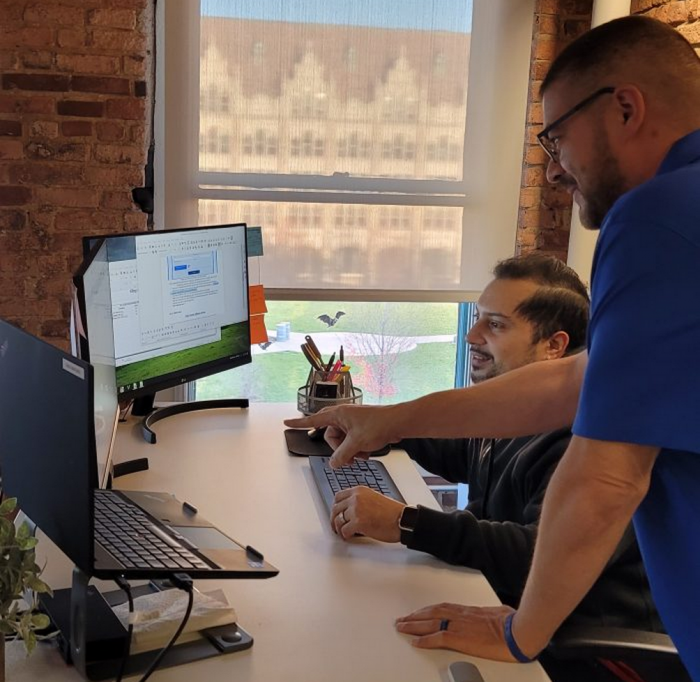

We’ve Got You Covered

Save hundreds on the mandatory publication requirement and protect your privacy by listing our Albany address on state forms.

Don’t waste time on tedious paperwork, either. Our local experts will file your Articles of Organization along with providing a full year of registered agent service.

Plus, conveniently view and manage your documents and services your secure online account. And as you grow, take advantage of our additional services, such as mail scanning and virtual office.

2. Choose your LLC Name

Choosing a name for your LLC is important for an obvious reason: it’s the name the world will associate with your company.

That may sound like a lot of pressure, and while it’s great to start with your forever LLC name, you can always come back make an LLC amendment or file a DBA with the state to do business under a different name. Name selection doesn’t need to be set in stone.

What’s actually most important is that your desired NY LLC name is available.

How to check if your name is available:

There are two ways to check name availability in New York.

- The simplest way is to search business name availability is to go to the New York Corporation and Business Entity Database. Search by entity name and select Limited Liability Company entity list. Then just enter your desired LLC name and you’ll see if someone else has already formed an LLC under that name. Keep searching until you find a satisfactory result.

- A official LLC name availability search is done when you actually begin the Articles of Organization online. The first step is to enter your preferred LLC name and the state will automatically check its availability in its database.

Before you begin the articles of organization online, however, you’ll need to obtain a NY.gov login ID. Obtaining this is a straightforward process, but it will require email verification.

New York LLC name requirements:

- The name of the limited liability company must contain the words: “Limited Liability Company” or one of the following abbreviations, “LLC” or “L.L.C.” These are typically called a designator.

- You can’t use certain words or phrases like “Bank,” “University,” and similar words that make it sound like your LLC is an official institution without prior approval from certain state boards.

- The LLC name must also be distinguishable from all other registered LLCs, corporations, and partnerships.

The state database will perform a cursory approval (only takes a couple seconds) before allowing you to proceed with your preferred LLC name

» Should I make an LLC name reservation?

Reserving an LLC name prior to filing may actually complicate and slow down starting your LLC. In our non-legal, non-lawyer opinion, we don’t recommend doing a name reservation in New York.

» Should I register a DBA?

New Yorkers often register a Certificate of Assumed Name (commonly known as a DBA) for their LLC because it allows for franchising and branding opportunities.

If you’re interested in registering an assumed name, you can select our Trade Name Service inside your account after signing up for our LLC formation service. We will register your LLC’s assumed name for $125 plus state fees.

3. Select a NY Registered Agent

New York is the one of the only states in the US where having a registered agent for your LLC is optional. The state by default receives all lawsuits (service of process) and will forward those documents to an individual indicated on the articles of organization. New York charges no additional fees for this service.

The only requirement to have New York handle your service of process is that the individual or company listed on the articles of organization must reside in a US state or territory. That means non-US citizens starting an LLC in New York will likely need to hire a registered agent.

But there are plenty of reasons why hiring an NY registered agent could be a good idea.

Why hire a registered agent in New York:

- Savings

Saving money on startup fees is the major reason why many LLC owners hire a New York registered agent. After you form an LLC in New York, you are required to publish notices in two local newspapers (a daily and a weekly) for six consecutive weeks within 120 days of formation. If your LLC is in New York City, that could very well mean upwards of $1000 in publication costs. However, if you hire us to register your LLC in New York, you can list our Albany address on your formation documents and publish in our town’s local paper, saving you hundreds, if not more. - Privacy

When you sign up for our New York registered agent service, you can list our contact information instead of your home address on your state forms. This is helpful for many reasons, namely, it protects your privacy. How? Using our address prevents potential clients from finding your information online, which is not ideal for many people. - Convenience

Our local registered agent service includes a free online account where you can track and store important documents, manage annual requirements and deadlines, as well as receive state notifications in one secure location. We make operating a New York LLC simple.

» How much does a NY registered agent cost?

Hiring a registered agent in New York could cost you anywhere from $49 to $500 a year. But this is one case where we don’t believe extra money actually gets you more. Many of our competitors charge hundreds of dollars for bare minimum service. Not us. We aim to create lifelong customers—not take all their money and run.

4. Register Your LLC with New York State

To register an LLC in New York, you need to complete the state’s LLC Articles of Organization. You can do this online in a matter of minutes. Follow along below and we’ll walk you through completing the Articles of Organization online:

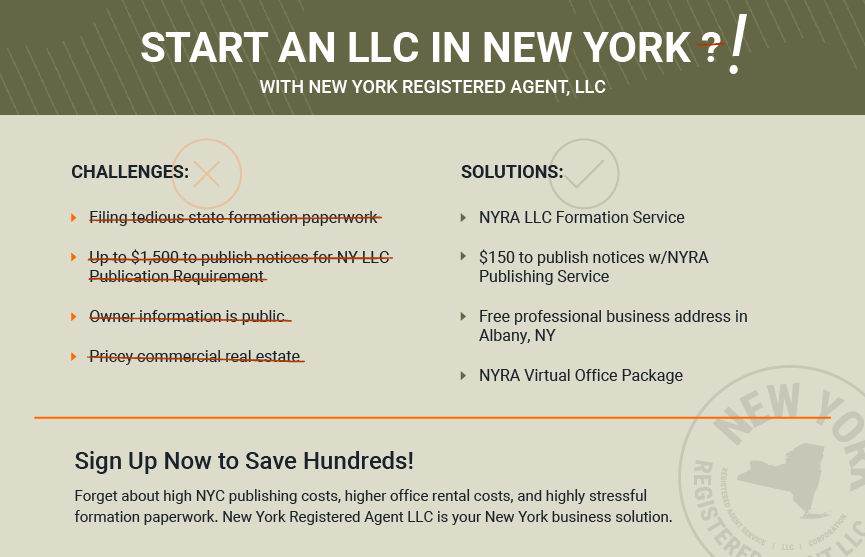

a. Begin the New York Articles of Organization

First, you’ll need to go to the New York Department of State website to complete the articles of organization. Once there, scroll down to select “Apply Online as an owner.”

Pro tip: On the state website, you may see information about filing times and expedite fees. Those times and fees are for paper filings. Online filings are automatically expedited.

b. NY.gov Login Credentials

After selecting, “Apply Online as an owner, you will be taken to a screen that prompts you to either enter your NY.gov ID login or to create a login.

Creating a NY.gov login is simple. You will need to enter your name and email and then complete the email verification process.

After you’ve created your NY.gov credentials, log in to officially get started on the Articles of Organization.

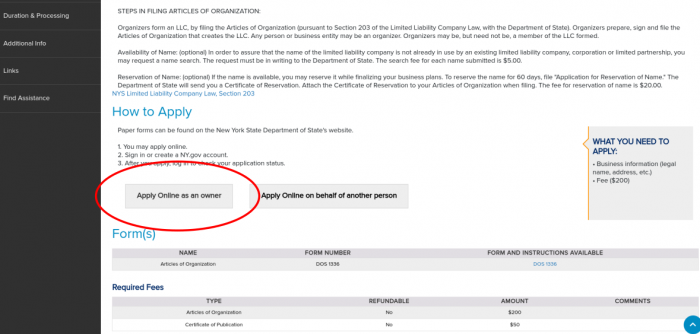

c. Name Determination

The first step to completing the New York Articles of Organization online is to enter your preferred LLC name. Remember to add the LLC name ending on any name you enter.

If the LLC name you’ve entered is already in use, you’ll see a red bar and the company’s information below.

Once you find an available LLC name, re-enter the name of your LLC exactly as listed and select “Save & Continue.”

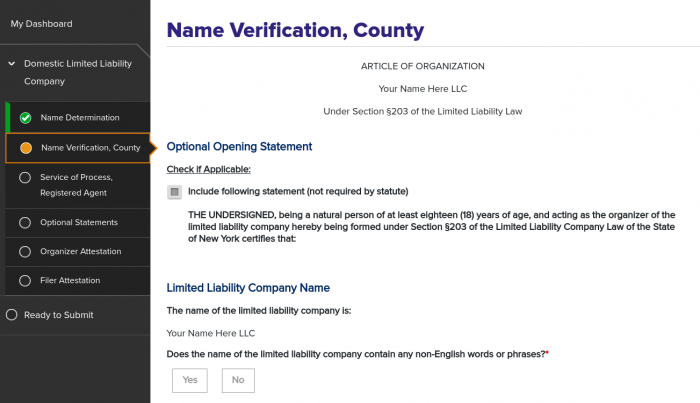

d. Name Verification, County

On this step you will be asked whether you want to include some optional clauses with formal language in your articles of organization.

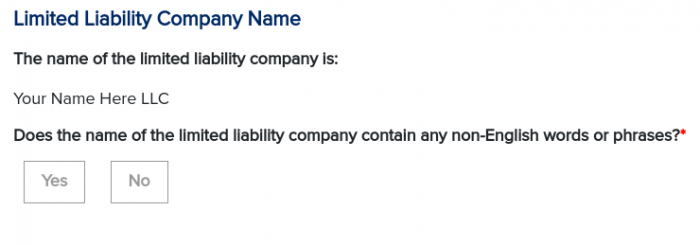

Then you will be asked to confirm whether there are any non-English words in your LLC name. If so, you will be asked to translate the word(s) into English.

The final question on this page asks which county your LLC will be located in. The county you list will be the county in which you’ll be required to publish LLC notification in two local newspapers. So, if you’re going to hire a registered agent that will let you list their address on your articles, make sure you list the county in which the registered agent is located.

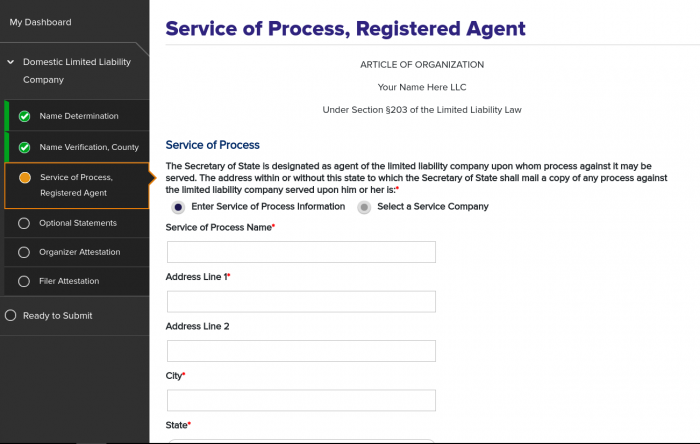

e. Service of Process, Registered Agent

As mentioned above, New York is the only state in the US that does not require you to appoint a registered agent. The state will handle your service of process on behalf of your company for no additional charge.

If you do elect to have the state handle your service of process, simply list your name and address and you can skip listing a registered agent. The only downsides are a loss of privacy and loss of ability to use a registered agent address for potential publication savings, as you’ll have to list your name and address in this section if you elect to have the state handle any LLC service of process notifications.

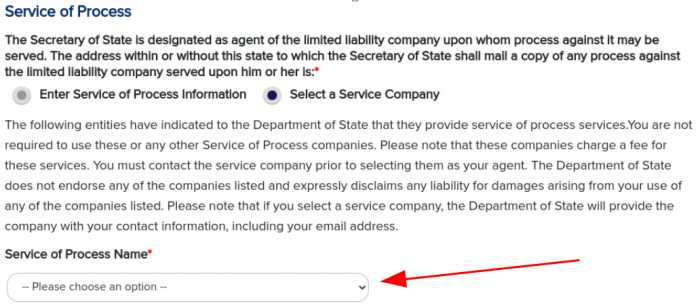

If you decide to hire a registered agent, the state website features a dropdown menu that let’s you select your registered agent from a list.

After making the selection, the fields will pre-populate with your agent’s information.

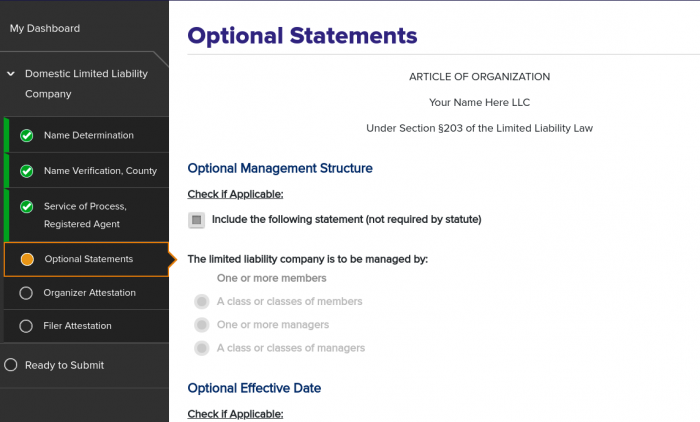

f. Optional Statements

This tab is filled with optional statements to be included in your articles of organization.

If you choose, you can include information about any of the following:

- the management structure of the LLC without listing the names of responsible managers.

- a delayed formation date if you do not want your LLC registered the day you file

- a set date of dissolution if you will be using the LLC for only a short period of time (some people do this for real estate deals).

- an indemnification statement. This statement does not necessarily afford you any increased limited liability.

To include any of the statements listed above, simply click the check box and that section will be included in your Articles of Organization.

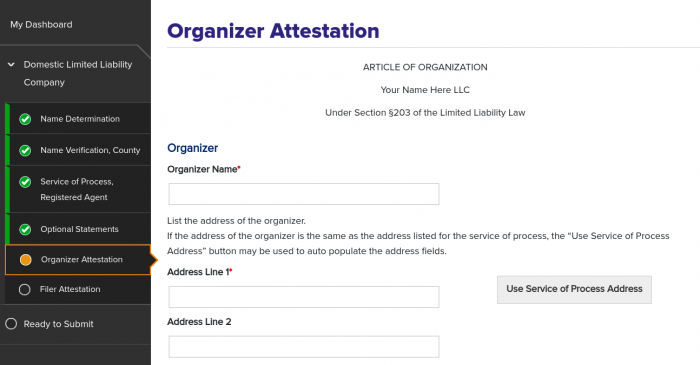

g. Organizer Attestation

An LLC organizer is the person or entity completing the articles. All you need is name and date.

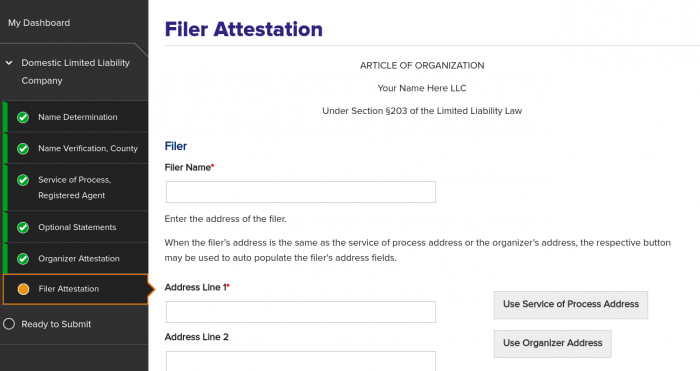

h. Filer Attestation

As a likely redundancy, you’ll need to list the name of the person filing the articles. The filer can be the same name as the organizer.

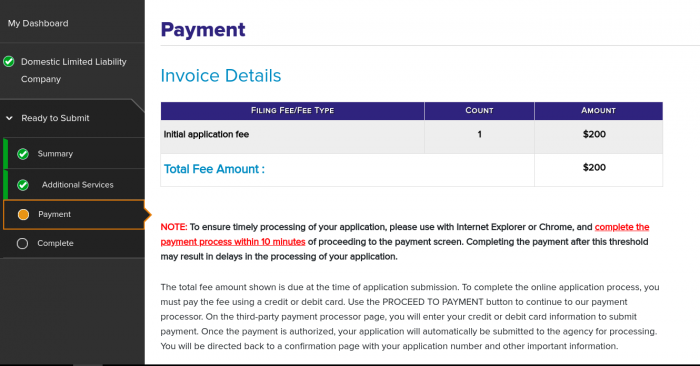

i. Submit Payment

To complete the articles of organization, you can pay the $200 state fee with electronic check or any major credit card.

» How much does it cost to start a New York LLC?

The state of New York charges a $200 filing fee when you form your LLC online. Paper filings can potentially pay more if you select any expedite options.

» How long does it take to complete the New York LLC Articles of Organization online?

Assuming you know your preferred name and whether or not you’ll hire a registered agent, completing the articles of organization will likely take you about 15 minutes. The NY Department of State will send you a confirmation email that your LLC has been created several minutes later.

5. Complete The NY LLC Publication Requirement

You’re not done after you file your NY Articles of Organization. The clock is ticking on fulfilling your NY LLC Publication Requirement. You have exactly 120 days to publish a total of 48 notices in two newspapers in the county where your LLC was formed.

Sounds bonkers, right? Well, it is. And it’s expensive, too, depending on where you’re registered. New York City LLCs can be looking at upwards of $1,500 to publish notices!

We have a solution.

Well, technically, two solutions.

How to save money on your publishing costs:

Solution 1:

a. Hire us to serve as your registered agent or form your NY LLC, and you can list the address of our office in Albany as your principal business address.

b. Albany is one of the cheapest places to publish in the state. With your business registered in Albany, you’ll pay less than $200 – TOTAL – in publication fees.

c. After you publish, the newspaper will send you an Affidavit of Publication. You’ll use it to file the Certificate of Publication ($50) with the Department of State.

Total cost: Approximately $200 (plus the time and effort to find and contact your newspapers, obtain the affidavit, fill out and file the Certificate of Publication, and make sure you do it all with 120 days of company formation)

Solution 2:

a. Hire us to form your NY LLC and add New York Publication Service at checkout ($150 plus publishing and state fees). Choose to have us list our address in Albany as your principal business address.

b. We’ll have your notices run in local Albany newspapers where the cost of publication is low – you’ll only pay $150 for publication.

c. We’ll obtain an Affidavit of Publication from each paper and submit the affidavits with the Certificate of Publication form ($75). We have your filing expedited, because the state’s processing time is famously slow.

Total cost: $375 (We do everything while you focus on doing business)

Prefer to file on your own?

Here are the general instructions for filing:

How to fulfill the NY LLC Publication Requirement:

What to do if you’re DIY-ing it.

a. Publish Legal Notices

Your notices must be:

- Published within 120 days of LLC formation

- Published in two newspapers (one weekly and one daily) printed in the county where your principal business address is located

- Published for six consecutive weeks (6 notices in the weekly, 42 notices in the daily)

Your notices must include:

- LLC name

- The date your Articles of Organization were filed

- The county where your business address is located

- Your business address

- Your registered agent information

- The future date of your LLC’s dissolution (if not perpetual)

- A brief statement about the nature of your business activity

Depending on your county and the length of your ad, publishing costs can range from about $150 to upwards of $1,000 (especially in NYC).

b. Get Affidavits of Publication

After publishing, you must obtain an Affidavit of Publication from each of the newspapers where you published your notices. The papers should simply provide this to you.

c. File Certificate of Publication

Finally, you’ll prepare and submit a Certificate of Publication, along with your Affidavits, to the Division of Corporations. The filing fee is $50. It’s $75 for an expedited filing (expediting is recommended).

» What happens if I don’t fulfill the NY Publication Requirement?

If you fail to complete the requirement within 120 days, the state will suspend your authority to conduct business in New York. This makes it extremely difficult to obtain business permits and licenses.

To restore your ability to do business, you must complete the requirement.

6. Create an LLC Operating Agreement

An LLC operating agreement is just what it sounds like: an agreement on how the LLC is going to operate. Hashing it out over pizza is great, but you need to get it in writing to keep your LLC and its members protected.

A strong operating agreement keep your business running smoothly, helps you resolve disputes swiftly, and protects your members’ interests should you end up in court.

In addition to laying out basic info about your LLC, a good operating agreement will get into the nitty gritty of your LLC’s structure and management.

Your operating agreement should include:

- Basic identifying information your business and its members: names, addresses, company purpose

- Management: Member/manager duties and rights

- Ownership: Membership contributions and ownership percentages, how profits and losses are allocated, procedures for adding or removing members

- Financial: Banking account and loan information, assets such as vehicles and property, ownership interest in other companies

- Resolving internal disputes: Procedures for handling member disagreements or conflicts of interest

- Dissolution or merger: Instructions for closing your doors or joining up with another company

- Amendments: The rules and process for adding provisions to your operating agreement

One advantage of our LLC formation service? You get a free, attorney-drafted operating agreement. Other business formation companies may charge you $100 or even $200 for operating agreement templates.

If you need somewhere to store your operating agreement and other business documents, we offer a variety of corporate books to keep you organized (available to order at checkout or in your online account). We also have custom embossing seals.

» Is having an operating agreement legally required?

Having an operating agreement for your LLC is a legal requirement according to NY state statutes.

» Do I need to file my Operating Agreement with the state?

You don’t have to submit your operating agreement to the NY Department of State – you can just keep your agreement on file for when it’s needed.

7. Get an EIN

An Employer Identification Number (EIN), also sometimes called a Federal Employer Identification Number (FEIN), is a nine-digit number assigned to your LLC by the IRS.

Your EIN is used to identify your LLC when you file taxes (if you have employees, they’ll also use your EIN to identify your LLC as their employer).

» Do I need an EIN?

If you’re a single-member LLC with no employees and no need to pay excise taxes, you can technically use your Social Security number. Otherwise, you need an EIN. And even if the law might not require you to get an EIN, your bank probably will.

» How do I get an EIN for my NY LLC?

You can apply online and get an EIN instantly.

Benefits of Forming an LLC in New York

We know that it’s easy to gripe about the NY LLC Publication Requirement, but there are some clear advantages to forming a New York LLC over a corporation or unregistered business like a sole proprietorship or general partnership.

Liability Protection

Liability protection helps keep your finances safe by preventing your personal assets (bank accounts, property, vehicles, retirement) from being seized to cover business debts. Forming an LLC creates a legal separation between you as an owner and your business.

This separation means you won’t be held personally liable for the debts and legal obligations of the business (with an LLC, you’re typically only liable for the amount you invested in the business). As a sole proprietor or member of a general partnership, you don’t have this separation, which puts all of your personal assets at risk.

Flexible, Streamlined Management

When you form corporation, you’ve got to elect a board of directors, and then the board has to appoint officers, and then officers may hire additional managers. Any major change that occurs has to go through the board, so there are a lot more meetings and a lot more hoops to jump through to get things done.

With an LLC, your owners (members) can manage or you can hire managers, and you can set up the management structure so that it functions however you want.

No Federal Corporate Taxes

LLCs do not pay federal corporate taxes (unless you choose to change your tax election to a C-corp or S-corp). You’ll only pay personal federal income taxes. Meanwhile, corporations must pay federal corporate tax and the corporation’s owners must pay personal income tax as well.

Types of Ny LLCS

What types of LLCs can you do business with in New York? Here’s an overview.

Limited Liability Company (LLC):

LLC owners are called members. There’s no legal limit on the number of LLC members you can have. Your LLC can be owned by one member, a hundred, or more.

Here’s how you and any fellow members, if you have any, can structure and manage your LLC.

Single-member LLC:

A single-member LLC is an LLC with just one owner. It’s a great choice for anyone working on their own who would like more security than a sole proprietorship can offer. As the owner of a single-member LLC, you have the option of using your social security number to file taxes instead of getting an EIN. However, you may want an EIN for banking purposes and to protect your personal information.

Multi-member LLC:

A multi-member LLC is an LLC owned by multiple individuals. In fact, there’s no legal limit on who many people (or companies) can own an LLC. With a multi-member LLC, you’ll need an EIN, and you’ll need to clearly explain how ownership interest is divided in your operating agreement to avoid future confusion and conflicts.

Member-managed LLC:

When the owners of an LLC also manage the business, it’s called a member-managed LLC. This can save you money because you don’t have to hire managers and allow you to stay touch with the pulse of your business. However, be cautious of disagreements that might arise between members if your management styles don’t align.

Manager-managed LLC:

If the owners of your LLC don’t want to deal with the day-to-day or won’t be on-site, you can hire managers and have manager-managed LLC. Make sure to lay out the duties and responsibilities of members and managers in your operating agreement so there’s no confusion and that managers are acting in accordance with member’s wishes.

Professional Limited Liability Company (PLLC):

A Professional LLC is an LLC for licensed professionals. In fact, most licensed professionals must form a PLLC instead of a regular LLC. This includes a wide range of professions, including doctors, lawyers, geologists, and athletic trainers. Go to our PLLC page to find out how to form a New York PLLC.

Foreign Limited Liability Company (FLLC):

A foreign LLC (FLLC) is an LLC that was formed in a different state and has registered with the Division of Corporations in order to do business in New York. Registering as an FLLC is a way to expand your business into New York without having to form a whole new LLC. Visit our FLLC page to more about how to register a foreign LLC.

Fees, costs, and taxes Breakdown

Of course, the true cost of starting your LLC will depend on a number of factors that can’t be address here. For example, how much you’ll spend stocking up on supplies, purchasing equipment, and other essential aspects of doing business will vary according to your line of work and how you’ve structured your work flow.

You may also need to pay additional taxes, such as Sales Tax if you’re selling tangible goods or services.

Here, we’ve covered the main fees and costs related to forming and maintaining your LLC with the state, along with the NY taxes that all LLCs must pay.

| Cost | Frequency | Amount |

|---|---|---|

| LLC Formation Filing | One-time | $205 |

| Publishing Newspaper Notices | One-time | $150 – $1,000+ |

| Certificate of Publication | One-time | $50 |

| Biennial Statement | Every two years | $9 |

| Annual Filing Fee Tax | Every year | $25 – $4,500 |

NY LLC FAQ

» How do I set up a LLC in New York?

To set up an LLC in New York, you need to file Articles of Organization with the NY Division of Corporations and complete the NY LLC Publication Requirement. Check out our guide to starting an NY LLC for complete instructions.

» How much does an LLC cost in New York?

It costs $205 to file your New York LLC Articles of Organization, anywhere between $150 and $1,000 (or more) to publish your LLC notices in local papers, and $50 to file your Certificate of Publication.

After that, you’ll need to pay $9 every other year to file your Biennial Report and the Annual Filing Fee Tax, which is $25 – $4,500, depending on how much income your LLC generate during the tax year.

» Can I be my own registered agent in New York?

Technically, the state will be your registered agent by default. But you can add yourself as an additional point of contact with the state when your file your articles. In this case, the state will reach out to you directly when legal notices and state documents need to reach your company.

Not okay with putting your name and address on a permanent public filing–but still don’t want to wait on the state for important notices? Another option is to hire a registered agent service, like us.

» What is a NY Professional LLC (PLLC)?

A New York Professional LLC, or PLLC, is a type of LLC reserved for companies that sell specific professional services. In New York, professional services include dentistry, engineering, and even interior design–basically, any profession regulated by a licensing board.

Licensed professionals in certain fields are required to form a PLLC rather than plain old LLC, but others can choose. For more information, check out our page on How To Form a New York PLLC.

» How do I register a foreign (out-of-state) LLC in NY?

Formed your business in another state and ready to expand into the New York market? Foreign LLCs are required to register with the Division of Corporations and receive a Certificate of Authority prior doing business in the state. For detailed instructions on registering, visit our page on How to Register a Foreign LLC in New York.

» What is a NY LLC Biennial Statement?

In NY, LLCs must file a Biennial Statement every other year. The Biennial Statement ensures that the information the state has on file for your LLC remains accurate. Failing to file can result in your business being marked as delinquent and losing its good standing with the state. Learn more on our page about the New York Biennial Statement.

To protect you from the negative consequences of missing your Biennial Statement filing, we include enrollment in Renewal Service with our LLC Formation Service at no upfront cost. We’ll remind you of the filing due date and then file ahead of time on your behalf ($100 + state fee). You cancel the service in your online account if you prefer to file on your own.

» What is the NY LLC Publication Requirement?

A unique quirk of NY LLC registration is the state’s LLC Publication Requirement. All domestic LLCs operating in NY must publish notices in two local newspapers (one daily, one weekly) for six consecutive weeks within 120 days of formation. After that, the LLC must get an Affidavit of Publication and submit the affidavit along with a Certificate of Publication form to the Division of Corporations.

The paper must be located in the county where your LLC has its principal business address, so not only is the requirement tedious, but publishing costs can also be high depending where your LLC is located (for example, you could pay $1,000 or more in NYC).

You can reduce publishing requirement hassle and costs with our LLC Formation Service. First, you get free use of our business address in Albany, New York. Second, add our New York Publication Service at checkout, and we’ll take care of publishing your notice in Albany County where publishing costs are much cheaper. Find out more about the requirement and our service on our New York LLC Publication Requirement page.

» Do I have to pay taxes on an LLC in NY?

LLCs don’t have to pay corporate taxes, but they still have to pay what’s known as an Annual Filing Fee based on their tax status and annual income using Form IT-204-LL. If your LLC files taxes as a disregarded entity, your Annual Filing Fee will be $25. If you file as a partnership, you’ll pay somewhere between $25 and $4,500, depending on your gross income.

And of course, there are state and local taxes that apply to certain business and activities, such as state, city, and district sales and use taxes. For a more information on NY business taxes, visit the Department of Taxation and Finance.

At the federal level, your LLC won’t pay corporate taxes (unless you elect to be taxed as a corporation). Your LLC members will pay personal income tax on their income from the LLC.

Ready to launch your NY LLC?

Avoid paperwork, save time and money, and get free resources and access to additional services?

It’s a no-brainer. Hire us!